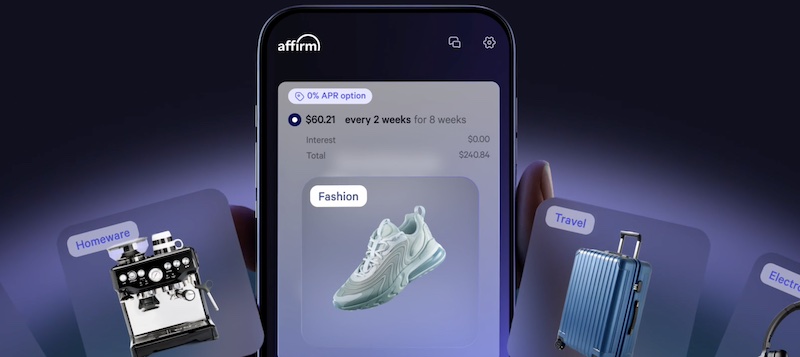

Affirm files application to establish Affirm Bank

Affirm announced that it has filed applications with the Nevada Financial Institutions Division and the Federal Deposit Insurance Corporation (FDIC) to establish Affirm Bank, a lending company based in Nevada.

The proposed company would enable Affirm to continue scaling its business responsibly while holding an FDIC-insured institution. This would help the company expand access to financial products for a broader range of consumers.

Since its founding over a decade ago, Affirm has provided nearly $130 billion in credit access, assessing the creditworthiness of approximately 60 million people, never charging late fees or hidden fees.

If the project is approved by regulators, the new entity will operate as a wholly owned subsidiary of Affirm, licensed in Nevada and covered by FDIC guarantees, with its own independent corporate governance and internal control systems. The planned subsidiary is intended to complement Affirm's existing business model and banking partnerships, providing greater flexibility and diversification, as well as supporting responsible innovation in financial services. Its launch could also create opportunities for the gradual introduction of new products and services.

"A banking company would strengthen and diversify Affirm's platform and help us deliver fair financial products to more people," said Max Levchin, founder and CEO of Affirm. "It's about expanding what we can offer consumers and merchants and building a company for the long term."

John Marion has been appointed CEO of Affirm Bank, bringing with him over 25 years of experience in driving innovation at the intersection of banking and fintech, gained in executive positions at JPMorgan Chase, Hatch Bank, MVB Financial Corp., and Comenity Bank. The bank will also be supported by an experienced management team and supervisory board with deep banking knowledge and a proven track record.

Also read

Coinbase introduces agentic wallets

News

Beast Industries acquires Step, expanding its platform with financial services

News

Gdynia kicks off the new season of FinTech Trends Poland. A nationwide series of meetings on financial technologies starts in the Tri-City.

News